Learn About Myindigocard

MyIndigoCard is a safe and easy way to get the Indigo Platinum Card. You can use this card to keep an eye on your account, pay your own bills, build your credit, solve problems with MyIndigoCard, make e-statements, and check your account’s transaction history.

As soon as you hear about MyIndigoCard, the first thing that comes to mind is “How to Join MyIndigoCard Portal.” This is how you start the process of getting a card and logging in to your account. There are a lot of things you should know about the MyIndigoCard Portal. To find out more about MyIndigoCard Portal, you’ve come to the right place.

There is a place where you can log in to your Myindigocard: www.myindigocard Activation

- Myindigocard Here, you can get help with “how do I sign up for my card?” and “how do I log into my indigo card website?”

- Step-by-step, you’ll find out “how to log into the myindigocard.com portal, how to activate your card, how to use myindigocard.com on your mobile, and more.” Make sure you read this whole article and follow the instructions.

- Using MyIndigoCard, you can give someone else access to the Indigo Platinum MasterCard Home Page at www.myindigocard.com, which is safe and easy to use. Then you can activate your account, sign up, and sign in to your account in a safe way.

- You can use Indigo Card to get and manage your Indigo Card, make payments on your bills, get electronic statements, keep track of transactions all day, and more.

Steps to register for myindigocard.com and start using it

If you want to use the MyIndigoCard, you first need to activate it on the official website at www.myindigocard.com. This means that you can keep track of your transactions, including how many transactions you’ve made in the past and how many transactions you’ve made now. Only after you activate it and log in to your account will you be able to use it It’s not too hard to set up the Indigo Card. The steps you need to take to activate your MyIndigoCard are shown below:

To start, go to www.indigocard.com to go to your first visit to MyIndigoCard, where you can sign up for an account.

- In the picture above, there is a “Register” or “Register” button. Click on it.

- Your MyIndigoCard Account Number should be sent in.

- Then, put in your birthday.

- Finally, enter your Social Security Number.

- After you have filled in the above information, click the “Next” button next to it.

- The steps above are the last steps in the process of activating your Indigo card. The Indigo card is on the table.

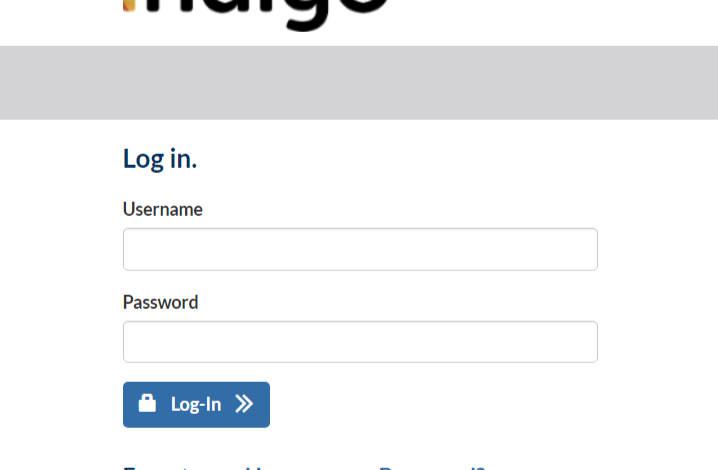

MyIndigoCard: I lost my username or password.

- The steps below will help you get your username and password back if you have forgotten them.

- Visit the official Myindigo site at www.myindigocard.com.

- Click “Forgot your Username or Password?” next to the Login button to get help.

- For getting your password back, you need to enter your username, the last four digits of your account number, your Social Security number, and your date of birth to do so.

- When you want to get your username back, you need to enter your email address, the last four digits of your account number, and your Social Security number and date of birth.

- It’s time to send.

- To make sure everything went well, you’ll get an email with a link to change your username and password.

How Much Do IndigoCard Charges and Interest Rates Cost?

- Each person who has an IndigoCard must know that the interest charges for a specific payment cycle include the following.

- In the calculation of acquisitions and advances, periodic interest charges are added up. They are calculated using the relevant periodical cycle rate or the periodic cyclic rates below.

- Every person who has a credit card must know how much money they owe and how much interest they pay each year. The average daily balance of the cash advances, including the new cash advances, and also the average daily balance of new purchases that were made.

- However, if the total costs are less than $ 0.50, the lowest interest charge of $ 0.50 will be imposed on these small amounts that are used as an interest rate on purchases as per the set rules.

- A currency translation rate costs 1 percent of the amount that changes to US dollars for a given transaction, including cash advances and purchases, so the interest rate is 1 percent of the amount.

- The interest you pay on purchases is based on the date of each transaction and the monthly interest rate. It is added to any unpaid debts that you still haven’t paid.

- There are a lot of good things about the Indigo Platinum Mastercard, but here are a few of the main

- You pay an annual fee for the Indigo Platinum Master Card based on your credit score and history. The fee ranges from $0 to $99.

- You get your credit line much easier and faster than you do with other credit cards.

- Even if you have filed for bankruptcy before, you can apply for this card and get it even if you have.

- Do not have to pay any kind of deposit.

- Not only that, but you can only get up to $300 in credit on this card.

Conclusion:

This is a special article that talks about how Indigo cards work and how they can be used for official things. If the cardholder wants to get into a better financial situation so that they can use credit, having a lot of credit cards to build or repair their credit makes sense.

The IndigoCard is especially good for people who have little or no credit and want to improve their credit score. Because your payment history is sent to the major credit bureaus every month, people can check their payments right away. This site gives you a safe way to improve your credit rating.

The Indigo Card is a great choice for people with intermediate or poor credit. With the card, you can quickly buy things. Also, if you use this site, your credit score will go up.

The IndigoCard is becoming more and more popular as a credit card for people with bad credit. This is a great resource for anyone who wants to check, grow, or improve their credit score.

With this card, you can get approved quickly and your credit score won’t be hurt. You can also get access to your mobile account at any time, use smart card technology, and more.