Predatory Lending: What You Need to Know

There are a lot of talks these days about predatory lending, but what is it, exactly? Predatory lending is when a financial institution takes advantage of someone vulnerable.

This could be because the person is not knowledgeable about financial products, is desperate for money, or has a low credit score.

Before you head over to find the best mortgage company in Dallas, Texas, you need to have a clear idea of predatory lending, how to protect yourself from it, and what to do if you fall victim to it.

What Is Predatory Lending?

Predatory lending is when a lender uses unfair, deceptive, or fraudulent practices to lure you into taking out a loan that you may not be able to afford.

The lender may also charge you hidden fees or inflated interest rates. This can leave you owing more money than you originally borrowed, and it can be challenging to get out of the cycle of debt.

Who Does Predatory Lending Target?

Predatory lenders often target people in vulnerable situations, such as those who are elderly and have bad credit. They may also target minorities or other groups that they think may be less likely to understand the loan terms.

Someone struggling to pay their bills may be tempted to take out a loan with terms that seem too good to be true. However, it’s essential to read the fine print and understand the loan terms before signing anything.

Why People Practice Predatory Lending

There are a few different reasons why people engage in predatory lending.

Some people do it because they think they can get away with it. They know that their victims may not be able to afford to hire a lawyer or fight back, so they take advantage of them. Others may do it because they’re desperate for money and don’t have other options.

Types Of Predatory Lending

There are many different types of predatory lending, but some common examples include:

Payday loans:

These short-term loans must be repaid in full when you receive your next paycheck. They typically have high-interest rates and fees, making them difficult to repay.

Title loans:

These are loans that use your car as collateral. If you can’t repay the loan, the lender may repossess your car.

Rent-to-own agreements:

These are agreements in which you pay to rent a piece of furniture or another item, with the option to purchase it at the end of the contract. However, these agreements often have high-interest rates and fees, making them more expensive than if you had purchased the item outright.

How To Know If You’re Being Offered A Predatory Loan

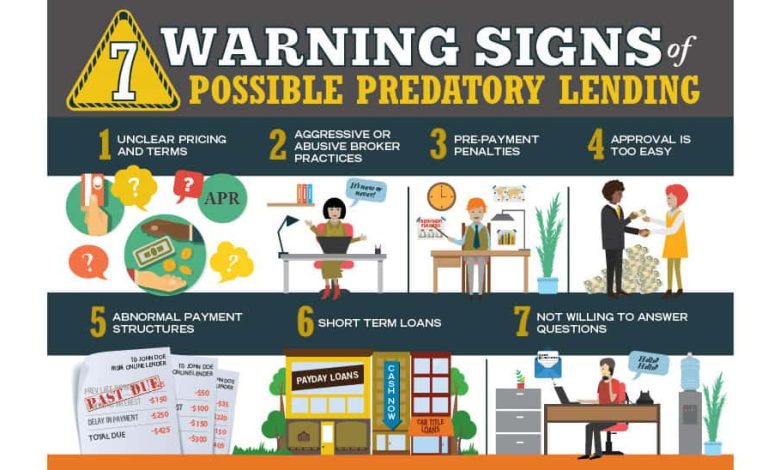

A few things to look out for may indicate you’re being offered a predatory loan.

The lender doesn’t check your credit:

A legitimate lender will typically check your credit before approving you for a loan. If the lender doesn’t match your credit, it may be because they don’t care whether or not you can afford the loan.

You’re required to buy insurance:

Some lenders require you to purchase insurance from them to get the loan. This is often unnecessary and expensive, and it’s something you should avoid if possible.

The terms of the loan are confusing:

If the loan terms are confusing or difficult to understand, the lender may be trying to take advantage of you. Make sure you know everything before signing any paperwork.

You’re told to lie on the application:

If the lender tells you to lie on your loan application, it’s a clear sign that they’re not acting in your best interests. Could you not do it?

How To Avoid Predatory Lenders

There are a few things you can do to avoid predatory lenders:

- Research any potential lender before doing business with them. This includes reading reviews, checking with the Better Business Bureau, and making sure they are licensed in your state.

- Never sign anything without reading and understanding it first. This includes contracts, loan agreements, and any other documents.

- Beware of lenders who try to force you into taking out a loan or make promises that seem too good to be true.

- Never give in to pressure to take out a loan on the spot. Take your time to research and compare offers before making a decision.

What To Do If You Think You’ve Been a Victim of Predatory Lending

If you think you may have been the victim of predatory lending, there are a few things you can do:

- Contact your state’s Attorney General or Department of Banking/Finance

- File a complaint with the Consumer Financial Protection Bureau

- Get in touch with a housing counselor or lawyer specializing in foreclosure prevention

Predatory lending is a serious issue that can have long-lasting consequences. By being aware of the signs and taking steps to avoid them, you can protect yourself and your finances.

Examples Of Predatory Lending

Predatory lending takes many forms, but some common examples include:

Loan flipping:

This is when a lender encourages a borrower to refinance their loan multiple times to generate more fees.

Equity stripping:

This is when a lender approves a larger loan than the value of the home. The borrower then has negative equity and may be at risk of foreclosure if they can’t make their payments.

Balloon payments:

This is when a borrower must make a large payment at the end of their loan term. This payment may be too high for the borrower to afford, and if they can’t pay it, they could lose their home.

Prepayment penalties:

A borrower is charged a fee for paying off their loan early. This can make it difficult for borrowers to refinance their loans.

Unfair terms:

This is when a lender includes terms in a loan that is unfair to the borrower. For example, a lender might charge a higher interest rate to a borrower with bad credit. Or, a lender might require a balloon payment on a loan only for a few years.

Conclusion

If you are thinking about taking out a loan, make sure you do your research and understand the loan terms. You can also talk to a financial advisor to get more information, but you need to be aware of the risks.