How to Calculate Present Value Interest Factor of Annuity (PVIFA)

How to Calculate Present Value Interest Factor of Annuity (PVIFA)

Blog Introduction: The present value interest factor of an annuity (PVIFA) is a financial concept used to calculate the present value of a stream of equal payments. The payments can be made at regular intervals, such as monthly or annually, for a specified period of time. The calculation for the PVIFA calculator takes into account the time value of money, which says that a dollar today is worth more than a dollar in the future.

How to Calculate PVIFA

To calculate PVIFA, you’ll need to know the interest rate, number of periods, and present value. The number of periods is the total number of payments you’ll make. For example, if you’re making monthly payments for 5 years, you have 60 periods. Present value is the lump sum amount you currently have.

If you want to get more information related to education then you can visit here articleft.com

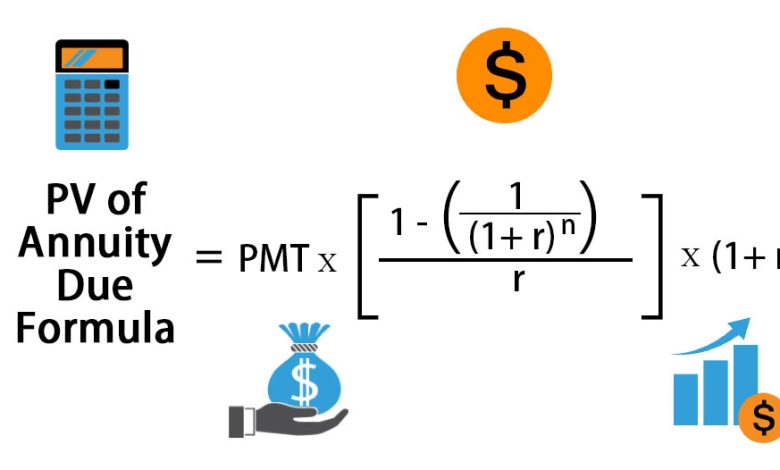

Once you have those values, plug them into this formula:

PVIFA = (1 – (1 / (1 + i)^n)) / i

i = interest rate

n = number of periods

For example, let’s say you’re making annual payments for 10 years at a 5% interest rate, and the present value is $1,000. Using the formula above, we get:

PVIFA = (1 – (1 / (1 + .05)^10)) / .05

PVIFA = 9.5489

This means that each payment you make over the life of the annuity will be worth $9.55 today. Knowing how to calculate PVIFA can help you understand the true cost of taking out a loan or making an investment.

The PVIFA formula may look daunting at first glance, but it’s actually not too difficult to calculate once you know what each variable represents. And understanding how to calculate PVIFA can be helpful in making financial decisions like taking out a loan or investing in an annuity.

RFM Investigation – What is it and How to Use it in Digital Marketing?

Blog Introduction: If you’ve been involved in digital marketing for any length of time, you’ve undoubtedly come across the term “RFM.” But what exactly is it? RFM stands for “recency, frequency, and monetary value,” and it’s a tried-and-true method for assessing customer behavior. It’s also an incredibly useful tool for developing targeted marketing campaigns. Here’s a brief overview of RFM investigation and how you can use it to improve your marketing efforts.

What is RFM?

RFM is a customer segmentation technique that assesses three key pieces of customer data: recency (how recently they made a purchase), frequency (how often they make purchases), and monetary value (how much they spend per purchase). This information can then be used to create targeted marketing campaigns that are designed to encourage customers to either buy more frequently, buy more expensive items, or both.

How to Use RFM in Digital Marketing

There are a few different ways to use RFM data in your digital marketing campaigns. One is to create segments based on customer behavior. For example, you might create a segment for customers who have made a purchase within the past week (high recency), have made at least three purchases in the past month (high frequency), and have spent an average of $50 per purchase (high monetary value). You can then target this segment with ads and emails that highlight special deals and offers.

Another way to use RFM data is to score each customer based on their recency, frequency, and monetary value. The scoring can be done on a scale of 1-5, with 5 being the highest. Customers who score high in all three categories would be considered your “best” customers, while those who score low would be considered your “worst.” You can then target your best customers with loyalty programs and other incentives designed to keep them coming back. At the same time, you can target your worst customers with ads and emails highlighting the benefits of becoming a better customer.

RFM calculator is a powerful customer segmentation technique that every digital marketer should be familiar with. By understanding how RFM works and how to use it in your marketing campaigns, you can encourage customers to buy more frequently, spend more per purchase, or both. Try using RFM investigation in your next campaign and see how it works for you!

If you want to get more information related then you can visit here articleft.com